What’s the difference between torque and horsepower?

Torque vs. horsepower explained: Discover how these forces affect acceleration, towing, and top speed. Learn which matters most for your driving style at Carma.

Planning to buy a car? If you’re thinking about using car finance, you’re in good company. It’s estimated around 2.4 million Aussies have a car loan, and around 9% of us are planning to buy a car with finance at some point. But taking out a car loan can feel a bit daunting due to the many car finance myths that abound - so let’s demystify these before you go signing any dotted lines.

There’s no one-size-fits-all answer to whether car finance or cash is a better option, because naturally this will depend on your circumstances. Not everyone has spare piles of cash sitting around - and for a lot of us, regular repayments can actually be the easiest way to pay off a vehicle purchase over time. So, there’s no need to stress if your mattress doesn’t have a crisp stack of 100 dollar notes under it for your next car purchase. There are finance options out there from a range of lenders that might suit your needs.

If you have a less-than-perfect credit score, don’t despair. Yes, Aussie lenders need to assess credit suitability to comply with responsible lending requirements. But that doesn’t mean you’re instantly out of the running for a new ride. Don’t call the loan shark just yet!

Reputable and licensed lenders may be able to offer specific conditions, adjust fees, or use the vehicle you buy as security to help you obtain finance. Some can consider other factors like income and employment history. And if you get car finance through Carma, getting personalised quotes for finance won’t affect your credit score.

It’s important to shop around when it comes to car loan interest rates and fees, because different lenders will offer different terms. Even small variations could save you significantly over a year and over the full loan term, so it pays to find the best loan conditions you can. This is exactly why we source quotes for used car finance rates and fees from multiple trusted lenders including Automotive Finance, Plenti, and Wisr. We help you compare different loan terms, with no obligation or hassle.

Plenty of people believe that you can only get a car loan if you buy new. This is not true - and at Carma we can source used car finance options to prove it!

It’s entirely possible to find a modern, pre-loved vehicle with competitive used car interest rates and affordable repayments. In fact - it could be a savvy way to buy, because a lot of new cars can see significant depreciation in the first year or two of ownership. Buying second-hand lets you purchase a late-model car with all the bells and whistles at a reduced price. You could also choose to sell or trade in your current car if you’re looking to bump up your buying power.

Lots of people buy a car under their own name, but if you’re an eligible ABN holder you might also have the option to buy one through your business. A used car loan could make a lot of sense business-wise, as it’s possible to find a great deal and potentially even claim those repayments as a tax deduction.

Your business will need to be eligible, of course, and it’s worth talking to your favourite bean counter to decide if this move is right for you. If it is, we can help you get started with finance quotes for your business.

This is another really common car finance myth. But in reality, one of the ways you can improve your credit score in Australia is to reliably meet your repayment obligations. Other ways can include lowering your credit card limit and paying any credit cards off on time.

It’s important to only take on credit that you know you can manage, as this can help you maintain and even polish up that credit score as time goes on. While it isn’t vital, getting pre-approved for a car loan can give you a lot more clarity about what’s affordable so you can shop around like a boss.

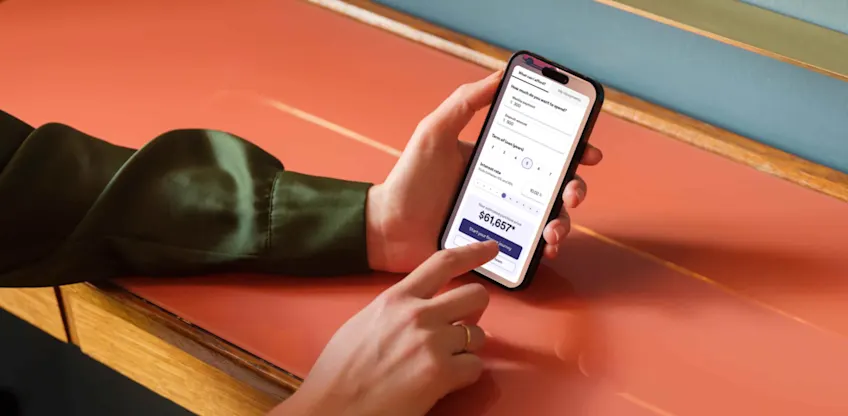

Want to figure out your potential price or repayments? Check out this handy used car finance calculator. You can also use it to find pre-checked cars that are ready to go in your price range.

You definitely don’t have to accept the first car loan terms you’re offered. In fact, you can stroll away at any time prior to signing an agreement. You can also choose your own lender if you’re buying through a reputable car market like Carma. Never let anyone push or pressure you into a finance deal, and don’t be afraid to take a breather to consider your options.

We know car finance can feel slightly riskier when buying a used car. This is why we cover any cancellation costs if you take out finance with one of our finance partners and decide to return your car within our seven-day return window*.

Buying a used car online with finance doesn’t need to be stressful now you know about the most common car finance myths. But of course, you might have more questions. If you have any queries about how car financing works or if you’re curious about which modern used cars in Sydney could suit your budget, feel free to give our team a buzz.

*Cancellation cost coverage applies only to customers where Carma originally arranged the finance through one of Carma’s finance partners, Plenti, Wisr, and Automotive Finance.

DISCLAIMER: Carma is not providing financial advice and nothing in this article is to be construed as Carma providing any financial advice. Carma recommends that its customers seek independent financial advice before making any decisions relating to their personal or business finances.

Torque vs. horsepower explained: Discover how these forces affect acceleration, towing, and top speed. Learn which matters most for your driving style at Carma.

Learn how to detail your exterior trim like a pro. From restoring faded plastic to UV protection, follow our DIY guide for a showroom finish.

Learn how Tyre Pressure Monitoring Systems work, the difference between direct and indirect sensors, and why they are vital for safety.