How to safely secure your dog in a car

Learn how to safely secure your dog in a car with our expert guide.

When you’re shopping for a new set of wheels and are exploring financing options, understanding how to calculate your car loan repayments is the best way to make an informed decision. Buying a car is a significant purchase, and knowing exactly what you'll be paying each month can help you choose the loan that’s right for you and budget efficiently.

In this guide, we'll walk you through all you need to know about how your car finance repayments work so you’ll be all ready for your next car. Whether you’re a first-time buyer or it’s your tenth car, Carma Director of Customer Finance Simon Bozzi is here with his top tips to start your finance journey with confidence.

Buying a new or used car typically lets you pay by cash or by taking out car finance. Car finance works quite similarly to other loans, which allows you to borrow a certain amount of money when it comes to buying a new or used car. Just like personal loans or home loans, car finance is made up of an interest rate, repayment period, and other fees and charges. A car loan is also securitised against the car as an underlying asset, very much like a home loan being secured by the property itself.

You can also choose to pay for the car with a combination of cash deposit and car finance. For example, someone looking to use their $20k in savings to purchase a car can also finance $10k on top, so now they can look at $30k cars instead of $20k cars. This could open up a wider range of vehicles for them to consider, better safety features, higher tech specs and more. You’ll then make regular repayments (monthly, fortnightly, or weekly) over a 2-7 year loan term.

To put it simply, a car loan is made up of the principal amount and interest, secured against the car itself and repaid over a 2-7 year loan term with upfront or monthly fees. Car finance repayments are typically based on a fixed interest rate and are principal and interest repayments. Fixed rate loans means your repayments won’t change over the loan term, which makes it easier to budget. Principal and interest repayments then mean a certain portion of your repayment goes to pay the interest and some towards the principal of the loan. Depending on which financier you choose, some may allow you to pay for your loan on a weekly, fortnightly or monthly basis.

“It’s important to understand how your loan and repayments are structured and what it means for you as the customer,” Simon advises, “you typically have options and choices when it comes to structuring the loan and repayments in a way that suits you.”

When it comes to structuring your loan, you can typically choose:

Other than the main components of a car loan, your repayments will also include other fees such as:

At Carma, we’re all about giving our customers options to make informed decisions that work best for them. By answering a few simple questions, we should be able to provide you with three indicative quotes, one from each of our finance partners. At most dealerships you may receive one quote from a dealership’s preferred financier whereas at Carma you receive three quotes — one from each of our preferred lending partners.

“It’s important to compare these quotes, and don’t fall into the trap of just comparing the annual interest rate,” says Simon, “more importantly you should also look to compare other aspects of the loan such as the upfront fees, monthly account keeping fees, what loan terms are available through each of the financiers, or any early termination fees.”

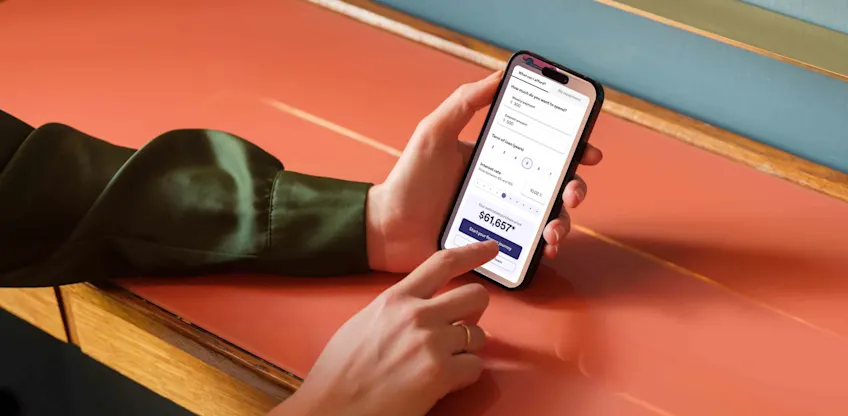

“We recognise the importance of this quote comparison step to make an informed decision, so we created an online personalised quote calculator where you can get an idea of what your repayments might look like,” adds Simon, “even if you haven’t found your specific car yet, the calculator is designed to provide you with personalised comparison quotes to help you start your finance journey.”

DISCLAIMER: Carma is not providing financial advice and nothing in this video is to be construed as Carma providing any financial advice. Carma recommends that its customers seek independent financial advice before making any decisions relating to their personal or business finances.

Learn how to safely secure your dog in a car with our expert guide.

Torque vs. horsepower explained: Discover how these forces affect acceleration, towing, and top speed. Learn which matters most for your driving style at Carma.

Learn how to detail your exterior trim like a pro. From restoring faded plastic to UV protection, follow our DIY guide for a showroom finish.